Financial EDI: All You Need to Know About EDI in Banking & Finance

Banks and financial institutions are understandably risk averse. Any new technology that might require the conversion of existing records into a new format may present opportunity for error. Errors are destabilizing, and banks always weigh the promise of greater speed and efficiency against the opportunity for loss.

However, as payment technology has continued to mature, standards for electronic data interchange (EDI) have evolved to safeguard the security of data transfer – and, with them, the security of financial electronic data interchange (FEDI) as a whole. At this point, FEDI is so widely supported that many businesses discourage cash transactions – including mass transit!

In this article we’ll explain what FEDI is and how it works, and explore its increasing role in commerce.

What is FEDI (Financial EDI)?

FEDI is electronic data interchange of financial data, in a standardized format. FEDI is mainly used by medium- to large-size companies and their trading partners, federal governments, and state governments, but essentially FEDI is everywhere you might pay for a good or service.

FEDI eliminates the need for paper-based transactions, streamlining communication between businesses and banks. It does this by providing a standardized format for financial data that is understood by software systems within financial institutions. Adopting the FEDI standard allows organizations to automate secure data exchange through software rather than relying on manual processes like email or fax.

The machine-readable, standardized formats FEDI supports include:

- Industry-specific formats

- Cross-industry formats

- ANSI X12 (used only in North America)

- UN/EDIFACT (used everywhere else)

- Proprietary formats

- Multi-function formats, such as purchase orders, shipping notices, invoices, and payments

The standards for these formats are developed and maintained by the Accredited Standards Committee (ASC X12), an independent organization chartered by the American National Standards Institute (ANSI) in 1979. ASC develops and maintains the X12 electronic data interchange transaction sets, standards for Context Inspired Component Architecture (CICA), and XML schemas that drive business processes globally.

Major ANSI X12 transaction sets are used for:

- Finance industry transactions (including tax return data acknowledgements, invoices, payment orders, and remittance advice)

- Retail and grocery industry transactions

- Healthcare and insurance industry transactions

- Transportation industry transactions

How does Financial EDI work?

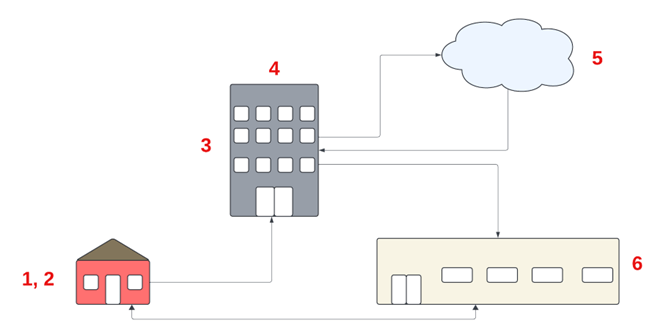

Financial EDI sets up a seamless handshake between seller and buyer, between buyer and the bank, and between the bank and the seller. Transaction data is formatted into an EDI-standard format the buyer’s bank can understand, and then an Automated Clearing House (ACH) delivers the payment to the seller.

A simple transaction can take as few as six steps:

- The buyer electronically extracts payment information from the seller’s Accounts Payable system, specifies their personal information, and sends the payment.

- Data is formatted into an EDI standard transaction set.

- The transaction set is transmitted to the seller’s bank.

- The seller’s bank formats the transaction set into an ACH transaction and transmits it through the ACH network.

- The ACH network delivers the payment and its associated data to the seller’s bank. The bank credits the seller.

- Payment information is transmitted to the seller’s Accounts Receivable system. The seller can see that funds have been posted.

10 common financial EDI X12 transaction codes

- EDI 139 – Student Loan Guarantee: Used by loan guarantee agencies to inform a lender or school about the status of a loan guarantee.

- EDI 144 – Student Loan Transfer and Status Verification: Used by leaders and guarantors to send or receive information about transferring ownership of a student loan.

- EDI 154 – Secured Interest Filing: Used when filing Uniform Commercial Code (UCC) financing statement forms, liens, judgments, and other statements of secured interest. Also used to exchange secured interest filing information.

- EDI 812 – Credit/Debit Adjustment: Used instead of sending a credit or debit memo. Serves as a multi-directional notification to trading partners about adjustments or bill-backs. (Bill-backs are charges to a marketing company when a commodity sells for less than the original asking price.)

- EDI 820 – Payment Order/Remittance Advice: Used to alert trading partners of an intent to pay an invoice or to order a financial institution to pay a seller.

- EDI 821 – Financial Information Reporting: Used to report balances, detail summary financial transactions and other related financial account information.

- EDI 823 – Lockbox: Used to transmit incoming payment information and totals from a bank or other lockbox service provider, to a lockbox owner. (A lockbox is a safe holding location rented by businesses to initiate B2B payment processing.)

- EDI 827 – Financial Return Notice: Used to tell an 820 originator that the transaction cannot be processed by the originating financial institution.

- EDI 828 – Debit Authorization: Used by payers to provide information regarding authorized debits to a financial institution. Frequently used in conjunction with ACH and/or EFT payments.

- EDI 829 – Payment Cancellation: Used to cancel a previously authorized electronic payment from a financial institution before the funds have been released.

Benefits of EDI in banking and finance

By delivering financial data electronically, FEDI improves the speed, efficiency, and security of traditional financial exchange, while keeping data quality and security high. It also enables banking and financial institutions to interoperate with, and provide, new services to customers.

The most important improvements are to the audit trail, which facilitates error tracing when transactions seem to go wrong. The resulting improvements in data security and quality save both customers and financial institutions time and money.

- Direct deposits: Before FEDI, people made direct deposits of cash or checks in person (at a bank or an ATM), or asked an institution that owed them money, to mail a check to their bank. However, ATMs are physically insecure. FEDI solves this by prearranging electronic deposits with addenda.

- Paper checks: Paying by paper check was supposed to eliminate the need to carry large sums of cash. Checks were drawn against existing funds. Paper checks were stored in a checkbook, and a record of how each check was used (payee and amount of check) were generally put in a ledger. But paper checks can be lost or stolen, written without reconciliation, or written against insufficient funds. FEDI answers these issues with electronic transactions against existing funds. `

- Credit card transactions: Paying with a credit card at the point of purchase eliminated the need to carry large sums of cash or write a paper check. But credit cards are insecure and can get stolen, lost, or hacked, leading to identity theft. Newer FEDI technologies eliminate the need to ever use a physical credit card. You can add the numbers on a physical credit card to an electronic wallet, and use that wallet to pay at the register. You can pay bills electronically through home banking services. If available, you can assign an “alias number” to a credit card, linked to a particular seller, which cuts down on credit card/identity theft.

- Peer-to-peer payments: Payments to individuals or small businesses through direct money transfer (peer-to-peer) could be arranged as bank-to-bank transactions, or money could be sent by “wire” through clearinghouse companies like Western Union. But these transfers often take 24 hours or more to clear and come with high transaction fees. Peer-to-peer apps, however, make it possible to pay a person or small business electronically and have the money available to them almost instantly.

Challenges of EDI in banking and finance

Banks and financial institutions save money once financial EDI is implemented, but it also costs time and money to get there. Most of the challenges of adopting financial EDI revolve around initial setup and training.

- Technical limitations & system inefficiencies: There are no one-size-fits-all templates for how to implement financial EDI processes. Each organization has to develop its own system. Such development takes time and money and may be at odds with the company’s desire to leverage existing infrastructure and interfaces.

- Security concerns: Implementing financial EDI almost always requires the institution to work with outside consultants, with whom they may be reluctant to share financial information. There may also be multiple security protocols in place, that must be satisfied in order to keep their certification.

- Other initial setup costs: The experience of implementing a financial EDI solution will expose areas where the existing employees need to be trained. Training takes time and may require as much forgetting (of the old procedures) as learning.

CData Arc: Modern end-to-end EDI

CData Arc simplifies EDI process flow with an interface that enables financial institutions to seamlessly connect with partners, send and receive EDI documents, and quickly automate EDI processes. Arc is compatible with both hub and spoke communication models, making it easier to onboard those partners. And if your company still manually moves data from EDI, you can automate months of work with over 100 EDI connections for ERP, CRM, marketing, finance, analytics, and more.

Arc streamlines the FEDI adoption process by providing no-code integration and translation of the FEDI standards. Tools like Arc help alleviate concerns about onboarding time, setup cost, and technical know-how. Choosing the right technology platform to solve FEDI challenges can help realize the benefits of FEDI while minimizing the costs.

Try CData Arc

Get a free 30-day trial of CData Arc today to experience the benefits of no-code enterprise-grade EDI automation software.